- Home

- Premium Memberships

- Lottery Results

- Forums

- Predictions

- Lottery Post Videos

- News

- Search Drawings

- Search Lottery Post

- Lottery Systems

- Lottery Charts

- Lottery Wheels

- Worldwide Jackpots

- Quick Picks

- On This Day in History

- Blogs

- Online Games

- Premium Features

- Contact Us

- Whitelist Lottery Post

- Rules

- Lottery Book Store

- Lottery Post Gift Shop

The time is now 10:45 pm

You last visited

April 25, 2024, 10:19 pm

All times shown are

Eastern Time (GMT-5:00)

Here's How Trump's Tax Plan Would Affect You

Published:

Updated:

Here’s How Trump’s Tax Plan Would Affect You

Donald Trump’s tax plan was revealed with a message for millions of Americans: “You win!”

But like everything linked to taxes, not everyone would win equally under his plan, which the Republican presidential candidate says is geared toward providing tax relief for the middle class and giving the U.S. economy a boost by lowering business income taxes.

To be sure, there’s a long road ahead before the general election in November 2016, but Trump’s proposal raises evergreen questions about the country’s tax system, such as why it’s so complicated and whether struggling middle-class families should get more of a break. Trump’s plan is geared to appeal to his supporters, one-third of whom earn less than $50,000 a year -- the group that the candidate claims would benefit the most from his plan.

Related: Trump Vows Lower Tax Rates, Deep Spending Cuts

Yet the biggest winners under Trump’s plan would be, well, people just like Trump: America’s richest citizens. That’s because he’s proposing a big reduction in income taxes for married couples earning at least $300,000, as well as a plan to eliminate the estate tax, which only kicks in at about $10 million per couple, said Edward Zelinsky, a law professor at the Cardozo School of Law, who specializes in tax issues.

“The truth is most lower income folks don’t pay tax in our system today anyway,” Zelinsky said, who added that Trump is claiming to remove people from the tax rolls who already don’t pay much, if anything, in federal tax. “Thanks to the earned income tax credit and standard exemptions, roughly half of Americans don’t pay significant income taxes.”

Trump’s plan is “really good for high income tax payers,” he added.

One caveat: Trump’s four-page proposal is short on details. As a result, some issues are unclear, such as his assertion that many deductions would be eliminated, although his plan maintains deductions for charitable giving and mortgage interest, which are two of Americans’ most popular deductions.

Related: Trump vs. Conservative Media: The War Is On

“This is a surprisingly vague proposal,” Zelinsky added.

Here’s how different groups would fare under his proposal:

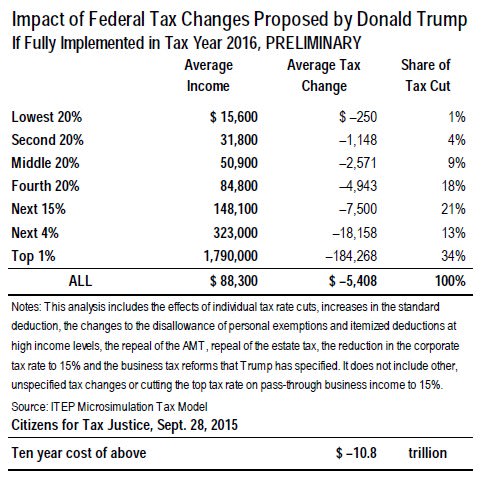

The 1 percent. The top 1 percent of taxpayers -- the Trumps of America -- would see the biggest benefits. With an average income of $1.79 million, the top 1 percent of income earners would see their tax bill plunge by $184,268, according to Citizens for Tax Justice. They would take home one-third of the tax cut proposed by Trump, excluding the estate tax elimination.

Households in the next 4 percent. With average incomes of $323,000, these earners would see their tax bill shaved by $18,158, accounting for about 13 percent of Trump’s tax cut, according to Citizens for Tax Justice.

Upper middle income groups. Americans with average earnings of $148,100 (the 80 to 95 percent) would see savings of $7,500, or 21 percent of Trump's tax cut. Earners making an average of $84,800 (the 60 to 80 percent) would pay $4,943 less in taxes, or 18 percent of the tax cut.

Related: Trump, Obama and Bush Agree: Close the Carried Interest Tax Loophole

The middle class and the poor. Do these groups really see a benefit, as Trump claims? Well, not so much. These groups would see a small tax benefit that pales in comparison to those that would be enjoyed by the wealthy. The middle 20 percent of American earners would see their taxes decline by $2,571, while the poorest residents would only pay $250 less in taxes – accounting for just 4 percent and 1 percent of Trump’s tax cut respectively, the CTJ noted.

Freelancers: Trump is proposing to lower the corporate tax rate to 15 percent for all businesses, including mom-and-pop stores and independent contractors. Because large corporations already use complex tax strategies to lower their tax bills, small businesses and freelancers might see the biggest benefit. The downside, said Zelinsky, is that Trump’s plan incentivizes employees to strike out on their own as independent contractors. A worker earning more than $150,000 as an employee would be taxed at 25 percent, but that would be lowered to 15 percent if she went out on her own. “I’m struck by the fact that this is very unfair,” Zelinsky added.

View photo

.

Comments

$250.00 in the lowest 20% means a lot to that wage earner for what they want to budget it for.

See, Speedy, theserious people go to desperate measures when the oxygen get's real thin. You and I have always maintained some reservation for some of the (R)'s while all the staunchest here hate all (D)'s. All this BS about if he does this, his people can that, he can move this around, and all he has to do is adjust that....all wishful thinking. In fact, it will end up worse than Reagan's deal where he ended up raising taxes more than any other president. More grading of his tax plan along with his Healthcare facade is on the way. Once it proves out to be quite the disaster, I'LL be back to do some drop kicking. For now, have fun with your guy playing with your fantasies...in his own words.

Math is the ENEMY to those who know not how to PROPERLY APPLY IT.

Post a Comment

Please Log In

To use this feature you must be logged into your Lottery Post account.

Not a member yet?

If you don't yet have a Lottery Post account, it's simple and free to create one! Just tap the Register button and after a quick process you'll be part of our lottery community.

Register