- Home

- Premium Memberships

- Lottery Results

- Forums

- Predictions

- Lottery Post Videos

- News

- Search Drawings

- Search Lottery Post

- Lottery Systems

- Lottery Charts

- Lottery Wheels

- Worldwide Jackpots

- Quick Picks

- On This Day in History

- Blogs

- Online Games

- Premium Features

- Contact Us

- Whitelist Lottery Post

- Rules

- Lottery Book Store

- Lottery Post Gift Shop

The time is now 6:03 am

You last visited

April 26, 2024, 1:28 am

All times shown are

Eastern Time (GMT-5:00)

Which Obama Policy Killed the Recovery?

Published:

Which Obama Policy Killed the Recovery?

Not long ago, we used stock market-style technical analysis to reveal that the policies implemented during President George W. Bush's tenure in office were most likely responsible for launching the economic recovery that followed the December 2007 recession and that the policies implemented during President Barack H. Obama's tenure in office were most likely responsible for derailing that recovery.

Since technical analysis is such a weak analytical technique, we thought we'd revisit that topic today using a combination of regression analysis and statistical analysis, focusing in on the one data metric that really defines a recession for most people: job layoffs.

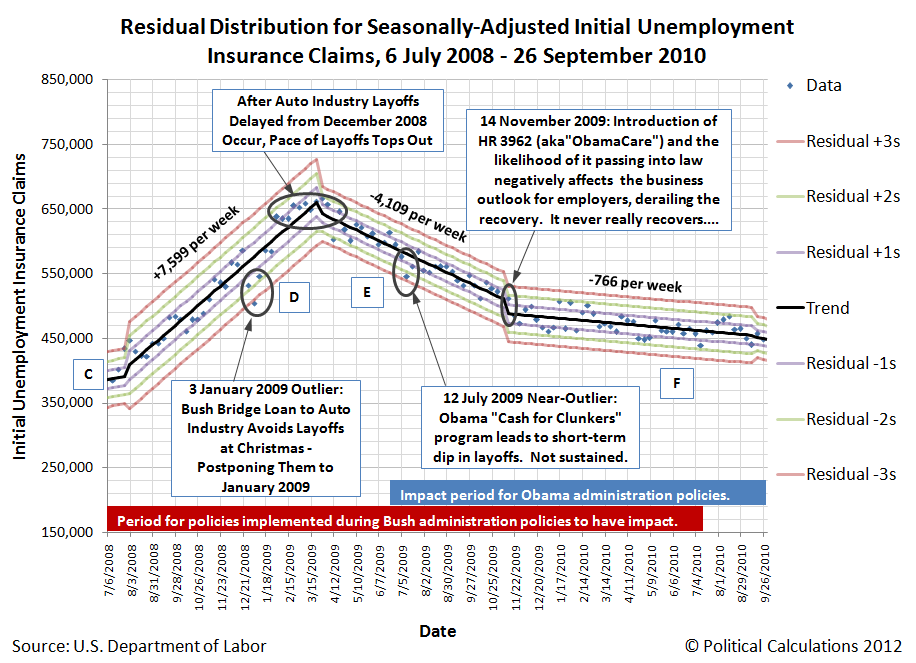

Our chart below uses the Bureau of Labor Statistics' data for the seasonally-adjusted number of initial unemployment insurance benefit claims filed each week for the period spanning 6 July 2008 through 26 September 2010, which tracks the number of job layoffs that occurred during this period. We've annotated the chart to show the major events that coincided with major shifts in the trend in job layoffs or that affected the trend in data for short periods of time.

In the chart above, we've also indicated Mark Thoma's "effectiveness lag", which represents the typical amount of time from when federal government policies are implemented to when they have a noticeable impact, which he indicates is 6 to 18 months long. We note that economists have long recognized this real world phenomenon and that its existence is widely accepted (except perhaps by philosophy professors who would seem to care more about credentials than thought.)

Here, the chart shows that the rate of layoffs in the U.S. was increasing at an average rate of 7.599 per week from August 2008 up until they peaked in March 2009. Along the way, we note an unusual outlier where the number of layoffs plunged in late December-early January, which corresponds to the emergency bridge loan that the Bush administration extended to failing companies in the auto industry to avoid massive layoffs during the Christmas and New Year's holidays in the U.S.

Those massive layoffs were only postponed however to the period from mid-January 2009 through February 2009, as the number of weekly layoffs in the U.S. stopped rising and topped out at this time. Without the Bush administration bridge loan to the auto industry, we note that the peak in layoffs during the recession would have occurred earlier.

After topping out, the pace of layoffs began to fall at a rate of 4,109 per week, which held up through mid-November 2009. There is one near-outlier recorded during this period, which coincides with the Obama administration's "Cash for Clunkers" program, which temporarily saw the number of weekly layoffs fall while it ran. And then, because the program could no longer be sustained, the rate of layoffs in the U.S. resumed the path they had previously been on.

All that changed after 29 November 2009 however, which President Obama's signature achievement of his administration, the bill that the Patient Protection and Affordable Care Act (aka "ObamaCare") was introduced in the House of Representatives as H.R. 3962. The introduction of this bill, the result of the Democratic Party's supermajority in the U.S. Congress which meant it was likely to pass, and the uncertainty it unleashed for employers combined with the higher costs it mandated for them, derailed the economic recovery. We observe that derailment in the sudden deceleration of the pace of recovery as the number of layoffs in the U.S. each week dropped from falling at an average rate of 4,109 per week to just 766 per week all the way through 19 September 2010.

And that, in a nutshell, is what President Obama did to kill off the strong economic recovery President Obama inherited and replaced it with the weak jobs recovery that has dominated ever since. The major trends in U.S. layoffs through all this period is described here, which explains the letters shown on the chart above!

Comments

Paul Craig Roberts

Infowars.com

Oct 6, 2012

October 5. Today’s employment report from the Bureau of Labor Statistics shows 114,000 new jobs in September and a drop in the rate of unemployment from 8.1% to 7.8%. As 114,000 new jobs are not sufficient to stay even with population growth, the drop in the unemployment rate is the result of not counting discouraged workers who are defined away as “not in the labor force.â€

According to the BLS, “In September, 2.5 million persons were marginally attached to the labor force.†These individuals “wanted and were available for work,†but “they were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.â€

In other words, 2.5 million unemployed Americans were not counted as unemployed.

The stock market rose on the phony good news. Bloomberg’s headline: “U.S. Stocks Rise as Unemployment Rate Unexpectedly Drops,†http://www.bloomberg.com/news/2012-10-05/u-s-stock-futures-little-changed-before-payrolls-report.html .

A truer picture of the dire employment situation is provided by the 600,000 rise over the previous month in involuntary part-time workers. According to the BLS, “These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.â€

Turning to the 114,000 new jobs, once again the jobs are concentrated in lowly paid domestic service jobs that cannot be offshored. Manufacturing jobs declined by 16,000.

As has been the case for a decade, two categories–health care and social assistance (primarily ambulatory health care services) and waitresses and bartenders account for 53% of the new jobs. The BLS never ceases to find ever growing employment of people in restaurants and bars despite the rising dependence of the US population on food stamps. The elderly are rising as a percentage of the American population, but I sometimes wonder if employment in ambulatory health care services is rising faster than the elderly population. Whether these reported jobs are real, I do not know.

The rest of the new jobs were accounted for by retail trade, transportation and warehousing, financial activities (primarily credit intermediation), professional and business services (primarily administrative and waste services), and state government education, where the 13,600 reported new jobs seem odd in light of the teacher layoffs and rise in classroom size.

The high-tech jobs that economists promised would be our reward for offshoring American manufacturing jobs and tradeable professional services, such as software engineering and IT, have never materialized. “The New Economy†was just another hoax, like “Iraqi weapons of mass destruction†and “Iranian nukes.â€

While employment falters, the consumer price index (CPI-U) in August increased 0.6 percent, the largest since June 2009. If the August rate is annualized, it means bad news on the inflation front. Instead of bringing us high tech jobs, is “the New Economy†bringing back the stagflation of the late 1970s? Time will tell.

Dr. Paul Craig Roberts is the father of Reaganomics and the former head of policy at the Department of Treasury. He is a columnist and was previously the editor of the Wall Street Journal. His latest book, “How the Economy Was Lost: The War of the Worlds,†details why America is disintegrating.

unemployment.BBBBBBBSSSSSSSSSS.

Do these A**holes really think people are that STUPID?

They are getting desperate to even suggest that nonsense, no wonder this country is on the Ba**s of their a**

His business regulations suck too.

Post a Comment

Please Log In

To use this feature you must be logged into your Lottery Post account.

Not a member yet?

If you don't yet have a Lottery Post account, it's simple and free to create one! Just tap the Register button and after a quick process you'll be part of our lottery community.

Register